Buying a Home Is Increasingly Out of Reach for Many Americans

First-time homebuyers who might have been able to secure a mortgage with little trouble a decade ago are facing increasingly difficult odds today. They’re crowded out of the housing market by rising home prices, investors and buyers with more cash, thereby keeping more people renting for longer, according to CONTI’s analysis.

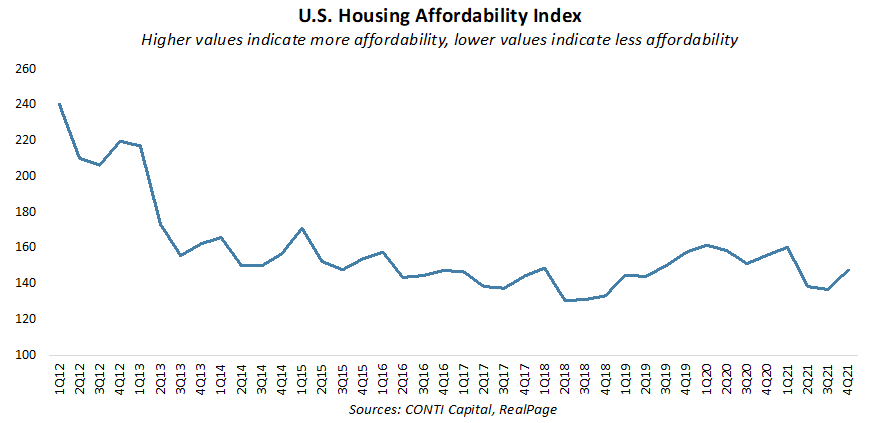

The graph below shows us the change in the Housing Affordability Index over time. This index, computed by RealPage, measures whether a family earning the median household income can qualify for a mortgage loan on a typical home in the market. At an index value of 100, a family with median income has exactly enough to qualify for a mortgage, with a 20% down payment on a median-priced home.

Subscribe now for more CONTI insights

The chart shows us that national home prices – from the most expensive to the least expensive markets in the U.S. – have become 33% more unaffordable since 2012. More recently, research by the National Association of Realtors (NAR) indicates that home prices have risen nearly 30 percent since 2019, and the average home is about $80,000 more than it was pre-pandemic.

Atlanta has seen the most drastic drop in affordability within the past year, according to the Housing Affordability Index, and cities like Phoenix, Dallas, Orlando and Tampa have also seen drastic price increases that surpass the national average.

Though wages have increased in recent months, they haven’t kept pace with home prices. This is weighing particularly heavily on the millennial generation – 90 million Americans who are in their prime years for first-time homebuying but are hindered at every turn.

Compounding the problem of the competitive housing market is that supply of new homes is sorely lacking, despite massive and mounting demand. There is currently 57% less inventory of homes now than there was in 2019, according to research by the NAR. Even as housing construction has ramped up in recent months, supply chain tangles hamper access to building supplies like lumber and lengthen construction timelines.

There are currently around 245,300 homes listed for sale that a household earning $75,000 to $100,000 would be able to afford, according to the NAR. By comparison, there were 656,200 homes that households in that income bracket could afford before the pandemic hit.

While rental prices have also increased significantly over the past year, renting is still a much easier financial ask for households when compared with the down-payment and long-term financial commitment of home ownership. Home buying affordability problems are expected to ease in 2022 and 2023, per our analysis, but not enough to make homeownership affordable again for many.