Do Single-Family Home Price Cuts Impact Multifamily?

The single-family housing market and the multifamily market are inextricably linked, and so when home prices and mortgage rates begin to fall, it begs the question – how will this impact rental real estate?

Eye-popping home prices and a rapidly increasing mortgage rate have shut more and more people out of the homebuying market within the past several months, pushing more people to rent for longer. This is arguably a boon for multifamily real estate since it creates more demand in that arena.

CONTI Capital closely tracks the single-family housing market in real-time in order to help project near-term multifamily performance.

Subscribe now for more CONTI insights

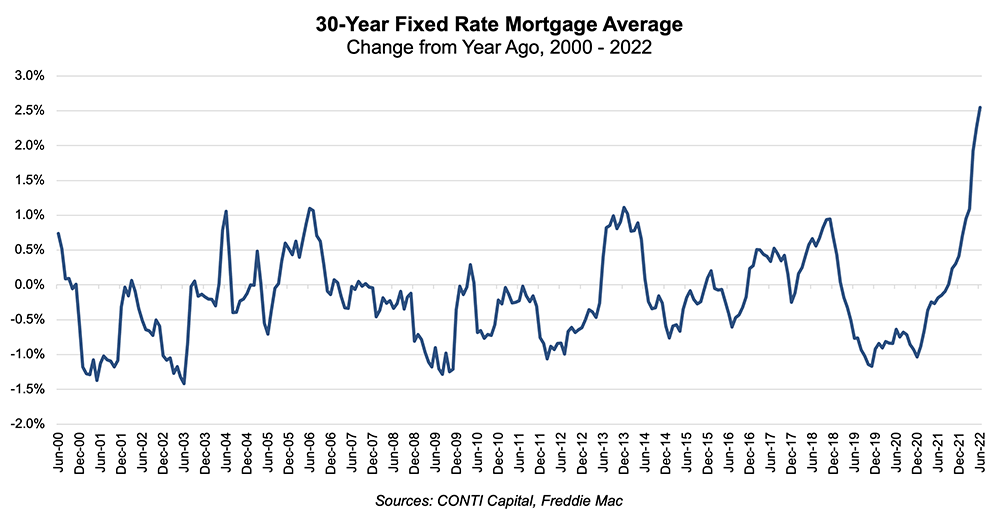

The primary impact of Fed rate hikes this year has been carried by the single-family housing market, where mortgage rates increased sharply for several months. The 30-Year Fixed Rate Mortgage Average increased from a low of 2.65% in early January 2022 to as high as 5.81% in late June.

For context, between the end of the Great Recession and the start of the COVID-19 recession, mortgage rates have averaged about 4.0%. Although mortgage rates today are not especially high in a historical context, the rate at which they have increased is unprecedented.

Sharply higher interest rates are exacerbating an already tight and expensive U.S. housing market. By our estimates, the combination of rising mortgage rates and home prices have increased the price of a monthly mortgage on a median priced home by $700 since the start of 2022.

An analysis by the Federal Reserve Bank of Atlanta points to plummeting housing affordability since 2021, catalyzed by the interaction of changes in household income, interest rates and single-family home prices. Early on, the downturn in affordability was driven by increasing home prices, while interest rates were extremely low. Thus far in 2022, rising interest rates are only compounding the lack of affordability.

As a result of so many potential homebuyers getting priced out of the market, there has been a decline in new and existing home sales since the Fed began raising interest rates, according to data from NAR.

Of course, the impact of rising unaffordability differs according to geography. Several of the markets we monitor have experienced price cuts over the past month, six months and a year, according to our analysis of Zillow data. Phoenix, Las Vegas, Denver, Tampa and Riverside led the pack in terms of the number of home listings with a price cut in June 2022. Nationally, 14.8% of all Zillow listings recorded a price cut in June, and hot Sun Belt markets like Orlando and Raleigh outperformed the nation during that period. Seattle, Phoenix and Austin were all markets that registered a growing number of homes for sale with price cuts over the past month, six months and year.

How much are prices actually decreasing? Not significantly, as the data shows.

In Phoenix – which led the U.S. in price cuts during June – the actual value of the price cuts recorded by Zillow amounted to only 2.3% of the median home value. This is also true in Tampa and Austin where price cuts as a share of home values were below the national number of 3.3%. These are all Sun Belt markets that experienced stellar single-family sale performance over the past few years, which pushed up home prices to levels that were largely unsustainable. The fact that these markets are recording below-average price cuts as a share of home values indicates the durability of demand in these markets despite significant changes in mortgage rates and affordability. While we do anticipate the Sun Belt will be impacted by the impending housing market slowdown, thus far, we aren’t seeing the turmoil that some analysts were expecting.

While rising mortgage rates and falling affordability is expected to cause a slowdown in new home sales—and indeed, this is what we see in some data sources—we would also expect to see a short-term increase in new home sales as homebuyers seek to close deals before mortgage rates move even higher. At the same time, many sellers are cutting prices to close deals before even more buyers are priced out of the market.

As Zillow data shows, over the past month we have seen double-digit increases in residential sales in many of the top U.S. markets. Only Chicago, Phoenix, Seattle and Las Vegas recorded a month-over-month decline in sales. On a year-to-date basis, only Las Vegas has recorded a decline. Finally, all markets except for one saw steep declines in residential sales between June 2021 and June 2022. The one exception was Dallas-Fort Worth, our top market for multifamily investments in the second half of 2022.

The shifts we are seeing in U.S. residential real estate are what happens when housing finance becomes significantly less accommodative. Demand remains exceptionally high for U.S. single-family housing, but supply of housing is constrained and will be so for the foreseeable future. The high-quality multifamily housing stock available today provides a good option for those potential homebuyers waiting for the market to readjust to fit their budget. We will continue to track real-time indicators of market strength and weakness as we execute on our investment strategies.