Equity and Debt Investing. Two Sides of the Same Coin

When looking to invest, you can choose to invest in a company’s performance or their debt. The simplest difference between the two is an investor’s appetite for risk, returns, and liquidity. Both approaches have their place in investment strategies, and some investors choose to diversify in both. Below, we’ll introduce some advantages of each and why both sides of this investment coin can make sense for many investors.

Equity investments are what many people might typically picture when they think of investing. Stocks are a good example. You are investing in a share of the future performance and worth of that investment. It’s a bet and a gamble. In real estate, this may mean periodic distributions (passive income) generated from rents as well as larger potential gains upon sale of the property. Either way, you’re risking that the investment will perform well and sell for more than your initial investment.

Subscribe now for more CONTI insights

Debt investors act as lenders, contributing capital based on predefined terms and a fixed rate of return. Bonds are an excellent example. You have no ownership or share. In real estate, the performance or sale of the property would not affect debt investors’ returns beyond the borrower’s ability to repay their debt. If the asset performs poorly, the owner, sponsor, or other equity investors absorb the losses first. If the borrower defaults, the loan is secured by the property. Either way, debt investments have some level of protection in comparison to equity investors. As a result, this approach is generally considered safer and will yield smaller potential returns.

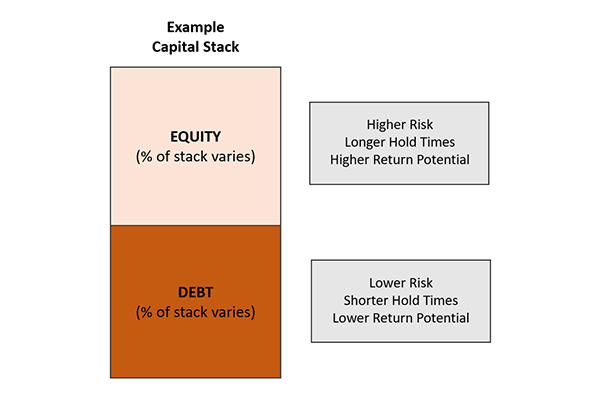

Both equity and debt investments are part of the capital stack; the typical components representing most investments. The basic chart below is for example purposes only, but it illustrates how an investor’s place in the stack affects the general risk, returns, and liquidity of their investment.

What Approach is Best for You?

There is more to risk than where you are in the capital stack. There is more to consider than potential rewards. What makes this a good investment in the first place? How long do you want your capital tied up? While the first question is an obvious one that is worthy of a much larger discussion, the second should always be answered ahead of time-based on your portfolio and investment goals.

Using real estate as an example once again, equity investments will generally involve longer hold times in order to realize returns; where your capital could be tied up for 5-10 years, or longer. Debt investments are typically on a predetermined payment schedule where returns are generally realized in as little as a few months or up to a few years depending on the asset, terms, and invested amount. Having full or partial liquidity is crucial to some investors.

At CONTI, we believe in providing the right investment opportunity for each investor based on their needs and goals. Over the last 13 years, CONTI has partnered with investors on $1.25B in transactions and can offer equity, debt, and mixed opportunities for your capital.

Would you like to know more about this topic or others related to multifamily real estate? Let us know.