The Equity Multiple: What It Is and How to Calculate It

The equity multiple is a metric central to real estate investment, as it succinctly defines how much return an investor might garner on their investment. In simple terms, “How much could I get back for every dollar I invest?”

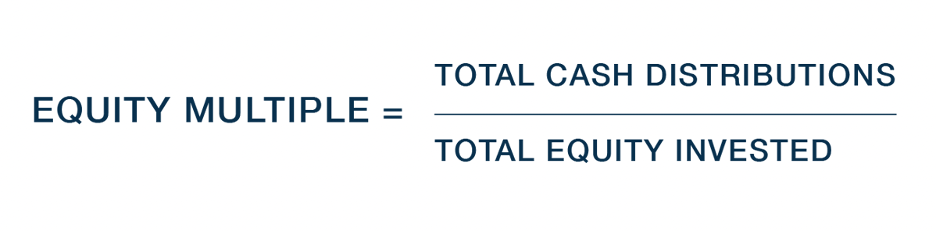

The equity multiple formula is thus: Total cash distributions* divided by total cash invested.

Subscribe now for more CONTI insights

The equity multiple is a metric central to real estate investment, as it succinctly defines how much return an investor might garner on their investment. In simple terms, “How much could I get back for every dollar I invest?”

The equity multiple formula is thus: Total cash distributions* divided by total cash invested.

Subscribe now for more CONTI insights

For example, if $100,000 is invested, and then the asset or fund is sold, distributions are paid and the investor receives $175,000,** then the equity multiple is 1.75x.

An equity multiple that is less than 1.0x means that the investor got back less for their dollar than he or she invested, and an equity multiple higher than 1.0x means the investor profited from the investment.

Caveats to the Calculation

The equity multiple is a useful number because it is relatively easy to understand – a novice investor should be able to look at the number and have an idea of what they could be getting in return for their initial investment. But the equity multiple provides an incomplete picture. Real estate investment always involves some level of risk, and the aimed-for equity multiple is not a guaranteed outcome. The equity multiple is just one of several factors that a potential investor might consider before putting capital forward.

Timing

One of the drawbacks of the equity multiple is that it doesn’t account for the duration of the investment. Referring back to the hypothetical 1.75x equity multiple above, that equity multiple might entice investors over a 3-year hold period, but it’s a less tempting premise if the proposed hold period is 10 years, being mindful of the impacts of inflation.

Varying Investment Structures

There are several different ways to invest in real estate, and so there will be different considerations for someone investing directly into an asset versus contributing to a fund, whether public or private.*** Additionally, some investment vehicles pay regular distributions, while others don’t pay out until the fund or asset is sold.

Risk

Many factors could impact the amount of investment risk involved with a particular real estate asset, such as the amount of leverage used for the purchase, the location of the asset, its age and tenant profile, market conditions, and much more. Being too focused on the aimed-for equity multiple might result in important risk factors being overlooked.

Comparing with the Internal Rate of Return

There are important differences between the equity multiple and the internal rate of return, or IRR. The IRR is the average annualized rate of return expected over the duration of the investment. Because the IRR accounts for timing, but it doesn’t speak to the total cash return the way the equity multiple does, it can be beneficial to compare the two metrics alongside each other to get a better sense of the value an investor might receive.

The Bottom Line

The equity multiple is a useful metric when evaluating a potential investment, but we feel it’s important to consider within a fuller context. While the equity multiple gets to the heart of an investor’s goals – that is, growing their capital – we feel it prudent to ask questions about the fund structure, distribution style, timing and the various risks involved.

* Net of all fees and expenses.

** The figures presented here do not account for tax impact and should be viewed as illustrative examples only.

*** Some investment vehicles may be subject to restrictions and may not be available to all investors.