A Look at Home Price Expectations Through 2025?

The pace of single-family home price growth has been increasing rapidly in recent years. Will this trend continue going forward? We feel it will. The low mortgage rate and lack of inventory point toward a continued increase in home prices above the long-term average.

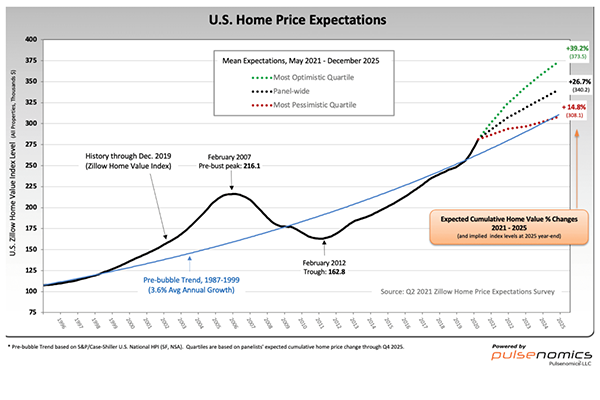

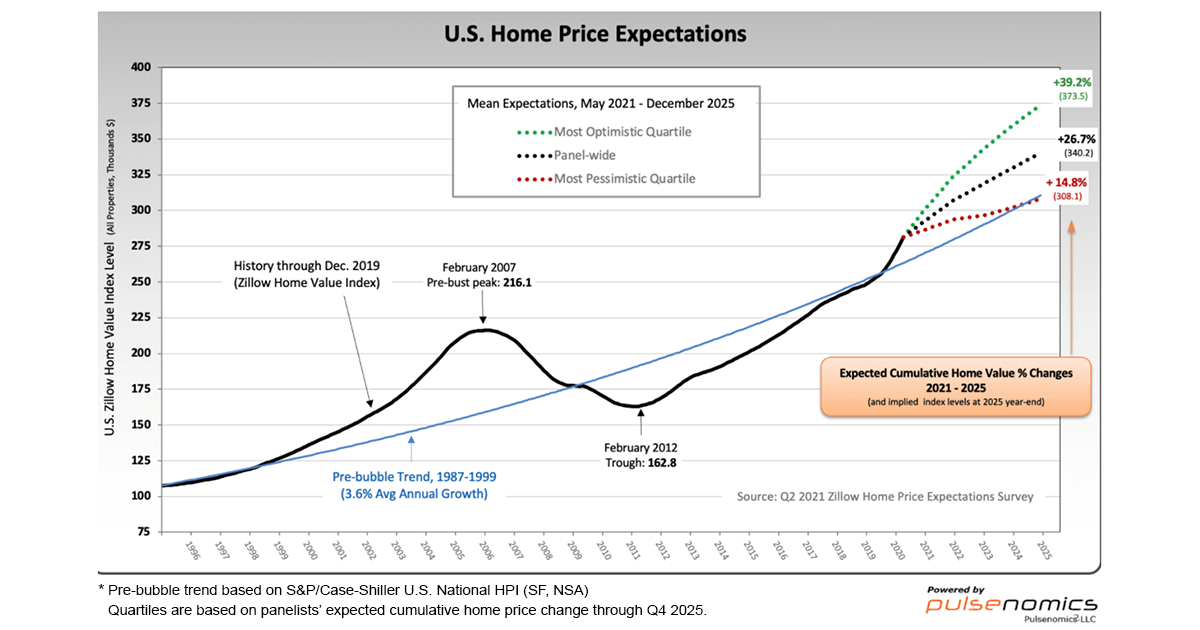

The chart below shows U.S. home price expectations based on a quarterly survey of economists and real estate experts. The Zillow sponsored survey attempts to aggregate professional forecasts on home values and other housing related issues. The dotted lines show the aggregate optimistic (green), average (black), and pessimistic (red) home price expectations.

Subscribe now for more CONTI insights

Reviewing the expectations for 2021-2025, the average forecast predicts 26.7% growth, or 5.34% annually, among panelists. However, this figure clearly disguises the annual growth discrepancy predicted by the most optimistic (7.9%) and pessimistic (3%) survey participants. While this difference is significant, we feel exploring the varying decision-making criteria behind their forecasts can be sidelined to focus on the underlying takeaway. Industry professionals agree that home prices will continue to rise at a rate that outpaces the 3.6% annual average that preceded the housing bubble.

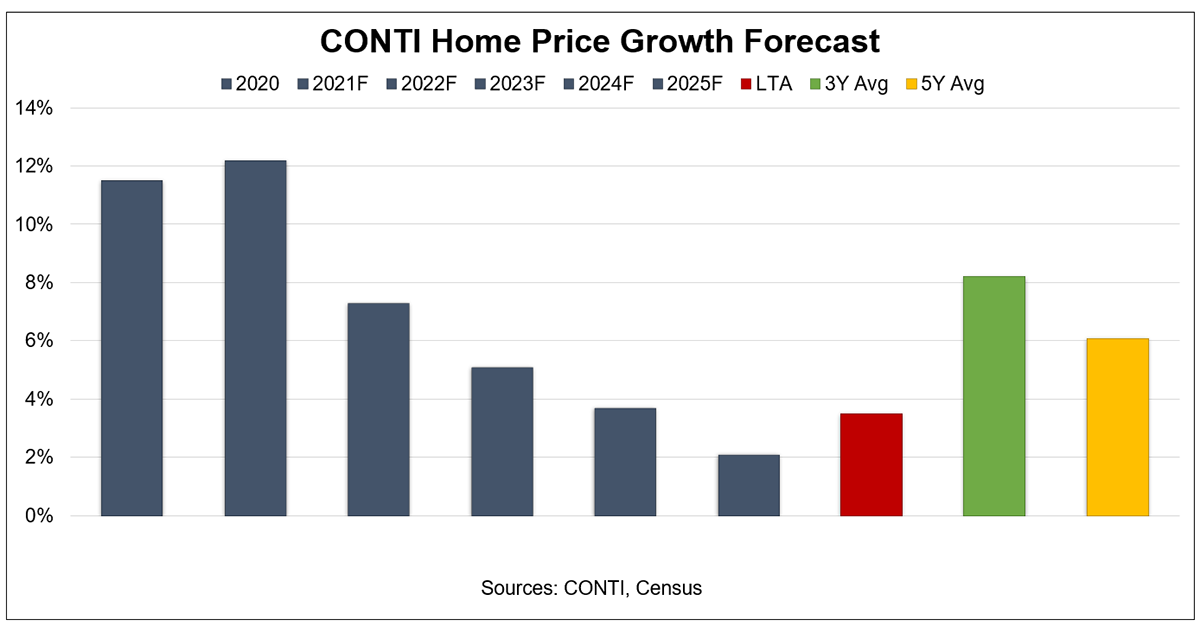

CONTI’s own home price forecast is forecasting 3 and 5-Year annual average home price growth to average 8.2% and 6.1%, respectively. Our 5-Year forecast is higher than the mean but lower than the optimistic growth recorded by the survey.

2020 annual average home price growth landed in the 10-11% range. Expect 2021 home price growth to record another robust rate but then begin decelerating. We expect decelerating price growth to bottom out during 2025 at about 2%.

We Must Figure Out Supply

Since the Great Recession, home price growth has been a function of lack of new supply rather than robust demand. Recently, unprecedented supply chain and labor issues have added further distress to supply constraints. Further contributors would include low mortgage rates and an increase in younger generations reaching home buying age and lifestyle changes.

Today, the pricing has gone so far out of balance that even a spec home’s final pricing can be delayed until the home is complete. More and more home buyers are either giving up or delaying home searches as they become increasingly priced out of markets.

How does the housing market reconcile supply, demand, and pricing? Builders must be able to build quicker and more cost efficiently so that competition brings down prices to a reasonable level. But, until the supply chain and labor market fully recover, we foresee home prices will continue their rapid rise.