Major U.S. Metros Are Seeing Stellar Job Growth Compared to Historic Norms

Americans are, in general, swimming in jobs. The labor market is currently one of the strongest pillars of the U.S. economy, reflecting a spectacular recovery from the employment drop that occurred at the advent of the COVID-19 pandemic. This is true whether looking at job openings, wage growth, the rate of quits or nominal job gains, per CONTI Capital’s analysis of data from the Bureau of Labor Statistics.

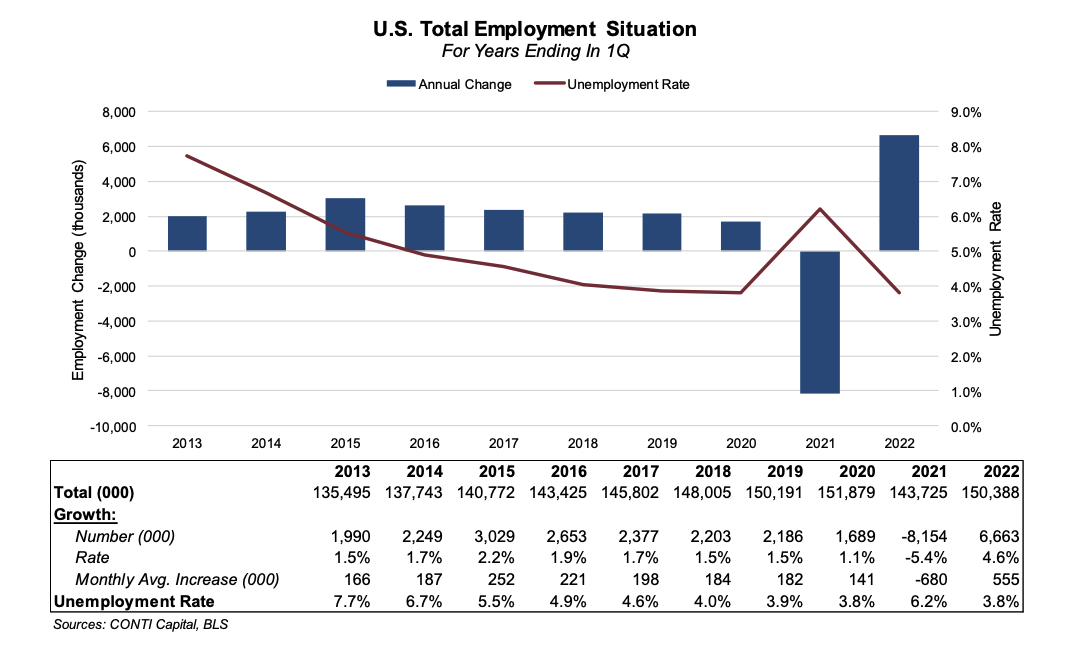

Employment numbers are released by the government monthly, but analyzing quarterly performance minimizes volatility in the data. In the year ending in 1Q2022, total U.S. employment was up by 6.7 million jobs compared to the year ending 1Q2021, a period that included the worst months of the pandemic’s impact on the labor market. This comes out to 4.76% in annual job growth, and an average of 555,000 jobs added to U.S. payrolls every month. The unemployment rate fell from 6.2% to 3.8% in this same period.

Subscribe now for more CONTI insights

Even labor supply is seeing some growth. The labor force participation rate (LFPR) is in general much less volatile than monthly employment numbers, because it captures the number of people employed and actively searching for a job. This metric offers us more insight on the fundamental strength of the labor market. LFPR growth will help ease inflationary pressures as Americans shift from stimulus-based to employment-based income increase. However, we saw a surge in retirement during the pandemic, which will hinder the U.S. in returning to pre-pandemic labor force participation levels.

The biggest chunk of the 6.7 million jobs added over the past year came from the leisure and hospitality sector, which contributed 2.2 million (or 33%) of the total. The growth in leisure and hospitality employment reflects a robust recovery in consumer spending as public health measures have lifted. Professional and business services jobs also contributed a significant portion to the total jobs gained at 17% of the total. Trade, transportation and utilities jobs also put in a strong performance with another 17% of total growth.

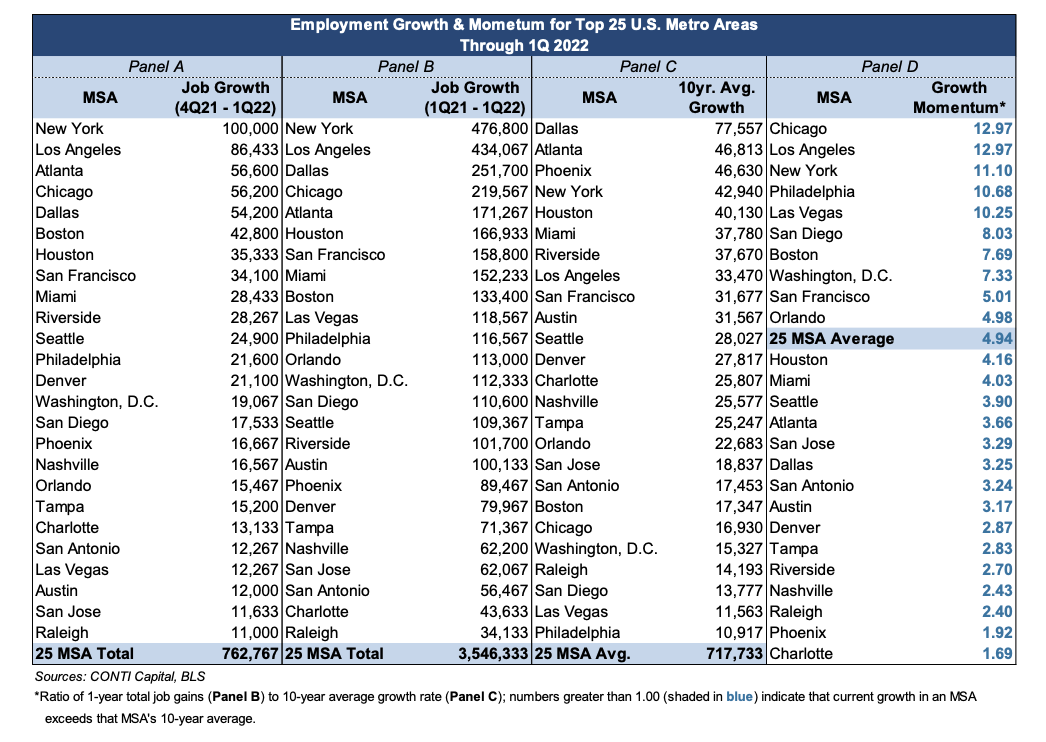

If we examine employment growth for the top 25 metros that CONTI tracks, it’s clear that job growth just over the past year is leaving 10-year average employment growth in the dust. Some of the markets currently experiencing explosive growth are the Gateway metros like Chicago, Los Angeles and New York that are only now recovering from pandemic losses. By comparison, most of the Sun Belt markets such as Charlotte, Dallas and Austin recovered all lost jobs several months ago, and yet are still experiencing very strong, above-average job growth rates.

New York, Los Angeles, Atlanta, Chicago and Dallas experienced the strongest nominal job growth between 4Q 2021 and 1Q 2022 as seen in Panel A. Each of these markets added over 50,000 jobs over the course of just three months. These markets also led total jobs added over the past year, as shown in Panel B.

If we look at market performance compared to recent history, it helps us understand not only where growth stands today, but also the direction growth is headed. Panel D compares each market’s job growth over the past year to the market’s 10-year average growth rate. When the growth momentum value is greater than 1.00, the current rate of job growth for that market is exceeding its 10-year average.

While Chicago has the highest growth momentum for 1Q2022, far surpassing its historic norms, the situation is distorted because Chicago is only now recovering from the COVID-19 labor market downturn.

On the other hand, markets like Charlotte, Phoenix, Raleigh and Nashville – all Sun Belt markets – already recovered their labor markets months ago, and are still seeing labor market growth rates significantly above their 10-year averages.

Charlotte, at the bottom of Panel D, saw yearly growth 69% higher than its historic average. Other Sun Belt markets saw stunning gains over the past year – Austin’s Q1 growth is 3.17 times its 10-year average growth.

The performance of the labor market is a major metric CONTI tracks while determining our target markets for apartment property acquisitions. In combination with significant in-migration to the Sun Belt, along with its affordability relative to Gateway metros as well as strong demand and supply indicators, this strong job growth performance gives us continued confidence in multifamily real estate investment within our target markets.