Supply & Demand: The Effects on Multifamily Workforce Housing

At the core of every investment lies projected future income. In the context of multifamily investment, future income is largely determined by the change in rents and occupancy over a given period. The basic goal of multifamily investment is maximizing the number of units rented at the maximum rent per unit. In a free and competitive market, these components of income (occupancy and rents), are constantly constrained by the laws of supply and demand. Although real estate investment requires highly localized supply and demand analyses to project an individual asset’s future income, broad market insights invite greater clarity to expected asset performance over time. By examining the past relationship between multifamily supply and demand in the major Texas markets, we can evaluate the future of this dynamic, and illustrate why workforce housing is best positioned for long-term income growth.

Subscribe now for more CONTI insights

While the rise of Texas to the prominence of American prosperity is a tale centuries in the making, the past decade of Texan growth is unrivaled in the modern U.S. Consistently ranking as one of the best states for doing business and providing an affordable cost-of-living, Texas is a land of exceptional opportunities; over the past decade, an astonishing 4.1 million new Texans arrived to seize them. Since 2010, this growth is equivalent to the entire population of Los Angeles relocating to the Lone Star State – a fitting comparison considering more Californians relocate to Texas than any other state. Aside from the impressive accolades as the nation’s top state for population and job growth over the past decade, these figures display the surging demand for housing across Texas.

The wave of people and jobs is the central driver for multifamily demand. This swelling demand over the past ten years placed upward pressure on multifamily rents as well as an increase in multifamily development in the state. This demand is evident in the stable multifamily occupancy rates across Texas; all of the large Texas metros – Dallas-Fort Worth, Austin, Houston, and San Antonio – averaged well above 90% annual occupancy over the past decade. While this stable occupancy rate provides a useful marker of demand, it does not adjust for the change in the market’s total units over time due to new construction. To account for the growing inventory of units, the real estate industry uses net absorption as a key indicator of demand over time.

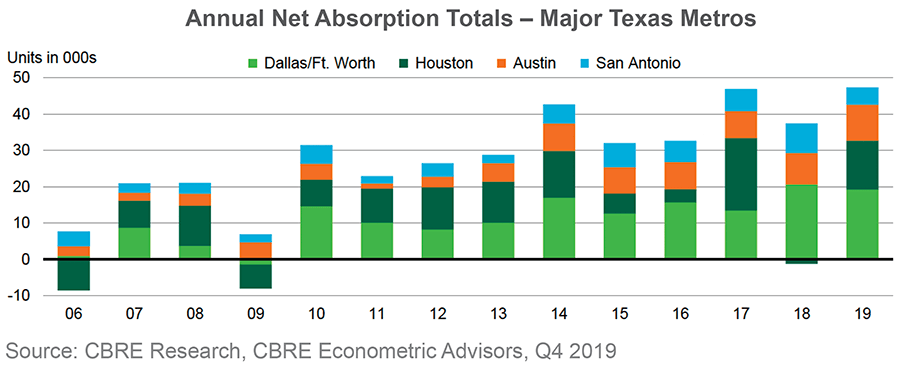

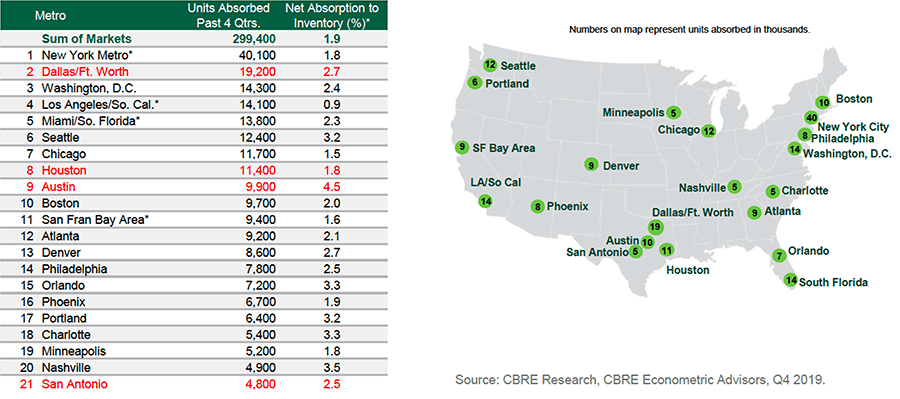

In the context of multifamily, net absorption is simply the sum of all units that became vacant subtracted from the sum of all units that became occupied within a specific market and during a specific period, usually one year. An annual positive net absorption indicates growing demand for that year – where more units were leased than vacated. Over the past decade, all four Texas metros averaged a positive net absorption, and cumulatively these markets absorbed over 350,000 new units. Demand for multifamily apartments in Texas is so robust that the state accounted for 15% of all U.S. absorption in 2019. Last year, DFW trailed only New York City in the total number of units absorbed, while absorption in Houston, Austin, and San Antonio respectively ranked 8th, 9th, and 21st across all U.S. metro markets.

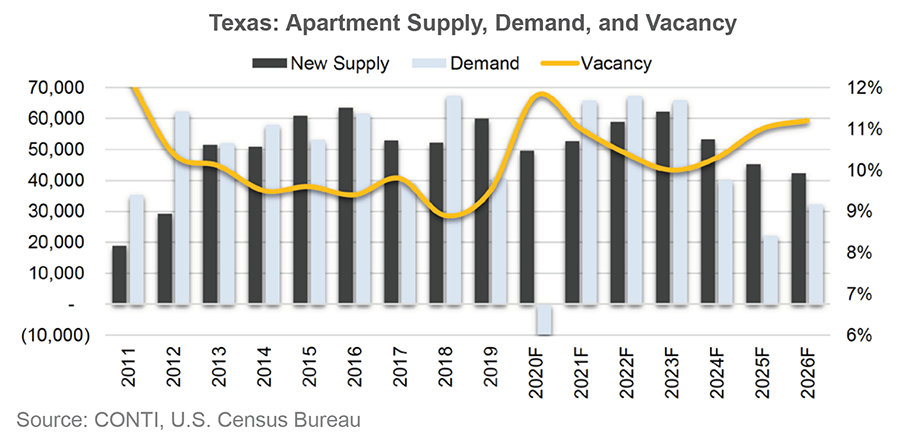

To summarize the past decade of Texas multifamily supply and demand, roughly 440,000 new apartment units were delivered from 2011 to 2019, averaging 49,000 units a year at a total unit inventory growth of 2.4%. During the same period, demand totaled close to 470,000 units, averaging a little more than 51,000 units absorbed each year. Demand outpaced supply by an annual average of 3,300 units per year, dropping vacancy by nearly 300 basis points from 2011 to 2019. More recently in 2019, Austin led the four major metros with 5% total revenue growth, followed by San Antonio (3.9%), Dallas-Fort Worth (3.8%), and Houston (1%). While all of the Texas markets possess their own unique characteristics, the fundamentals of population and job growth have propelled stable long-term income growth for Texas multifamily investments.

The balance of Texas multifamily supply and demand over the past decade displays market conditions favorable for investment. While Texas is consistently a leader in the number of new units constructed per year, this new supply has been outpaced by overwhelming demand in the recent past. Ultimately, the increased scarcity of apartments also increased rents across the market, resulting in attractive returns over the past decade. As investors continue to recognize the long-term stability of the Texas multifamily market, investment activity over the past decade has also reached impressive new heights.

According to the world’s largest real estate investment services firm, CBRE, Texas captured 14% of all U.S. multifamily investment in 2019. Last year, one in every six units purchased in the U.S. was located in the major Texas metros, representing over $24 billion in transaction volume. Backed by powerful demographic trends and historically dependable performance, the multifamily investment market is unlikely to yield its decadal momentum despite the economic disruptions caused by the coronavirus pandemic.

While the near-term outlook for the multifamily investment market may be clouded by economic uncertainty, we maintain our focus here to the long-term landscape of multifamily investment in Texas. Once the current uncertainty recedes, we expect the Texas unemployment rate to return to 3.4% by 2023, similar to the rates of 2017 and 2018. This healthy labor market is essential to the continually growing demand for multifamily. We also expect that the underlying factors driving domestic migration to Texas – the low cost-of-living, the relative ease of doing business, and the favorable climate – are not in jeopardy.

With these long-term fundamentals firmly in place, we are forecasting demand to outpace supply once again by an annual average of 8,500 units from 2021 to 2023. We expect new supply and net absorption to average 57,900 units and 66,400 units, respectively. Over the longer-term, we expect new supply to outpace demand from 2024 to 2026 as the state and nation face potential economic stagnation midway through the decade. Despite these potential headwinds, we believe Texas multifamily investments, and specifically workforce housing, will continue to achieve attractive long-run returns. Throughout this article’s exploration of Texas multifamily supply and demand, we have made some generalizations about the nature of these market dynamics for the sake of simplicity, education, and the ease of comparison over time. In reality, this nature is highly nuanced and highly favorable to workforce housing investments.

To understand this nuance, we must examine the constraints of both supply and demand. Due to rising input costs like land, labor, and raw materials, the economic feasibility of creating new market-rate workforce housing is nearly nonexistent. Instead, multifamily developers continue to build luxury apartments with significantly larger rents than their workforce housing counterparts. In the short-term, this strategy can prove lucrative for some developers, but beneath the initial high returns is a difficult reality: expensive new supply, despite its glamour, simply does not meet the housing needs of the average worker in the long-run.

Over the long-run, Texas, as well as many other U.S. markets, will continue to experience a mismatch between the rents required by the average worker and the exorbitant rents of new supply. Despite our position that new supply in Texas may soon outpace demand, the relationship is heavily weighted toward the luxury apartment market segment. Due to this mismatch, we fully believe that the workforce housing segment will face stable demand, sustainable upward pressure on rents, and consequently, sustainable long-term returns.

CONTI believes our workforce housing strategy, one that emphasizes the alignment of affordability to the average worker’s income, is subject to less volatility and better reflects the true housing needs of our target markets.