The Rise of the High-Income Renter: A CONTI Perspective

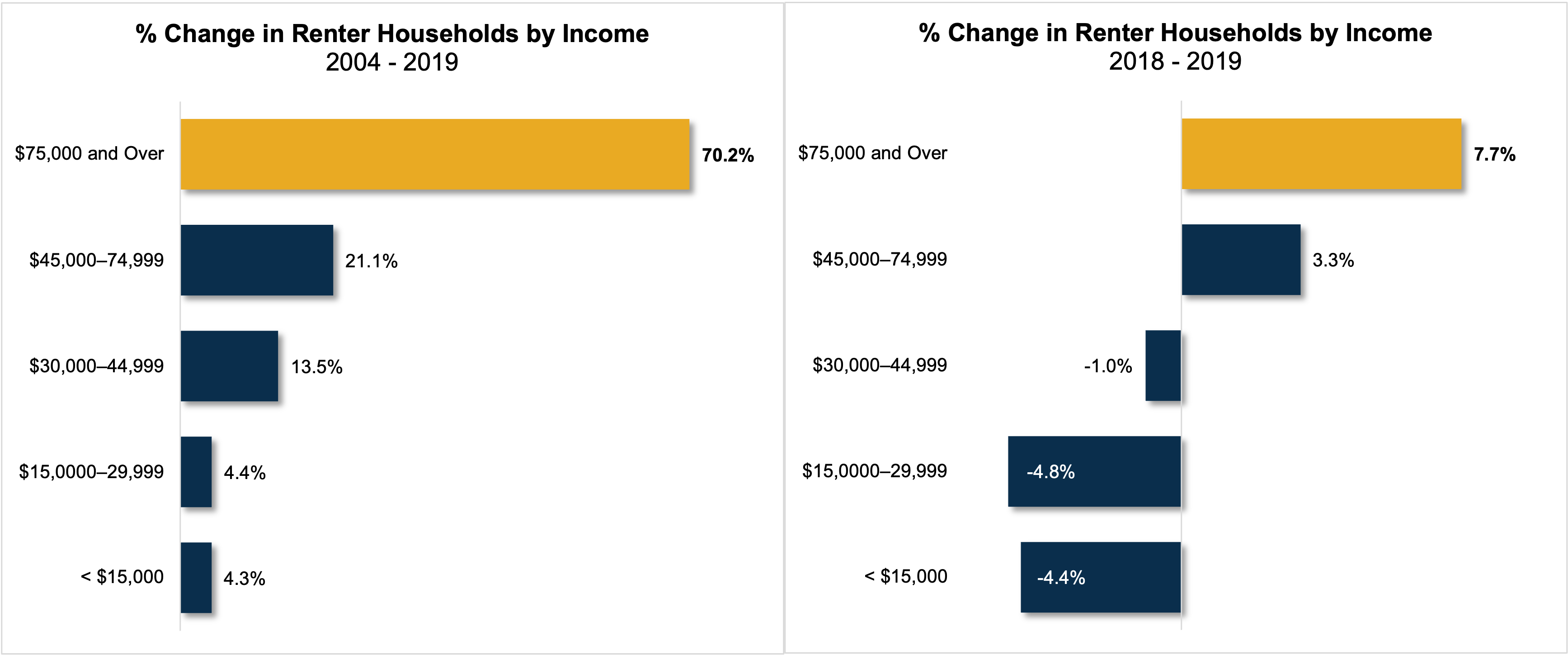

The number of renters with six-figure salaries has grown much more rapidly between 2016 and 2021, according to The Wall Street Journal. Our own analysis of renter income data from 2004 to 2019 seems to reinforce this. As we can see below, this increase in relatively high-income renters has been building for over a decade, which suggests these renters will likely continue to impact demand for multifamily products for at least the next two to three years, barring any drastic economic shifts.

Subscribe now for more CONTI insights

The number of renters with six-figure salaries has grown much more rapidly between 2016 and 2021, according to The Wall Street Journal. Our own analysis of renter income data from 2004 to 2019 seems to reinforce this. As we can see below, this increase in relatively high-income renters has been building for over a decade, which suggests these renters will likely continue to impact demand for multifamily products for at least the next two to three years, barring any drastic economic shifts.

Subscribe now for more CONTI insights

The Circumstances

During the COVID-19 pandemic, the U.S. government distributed stimulus cash to give a leg-up to struggling households, bolstering the economy at large. High-income households had less need of this stimulus boost and were also less likely to have lost their jobs during the pandemic1 – in fact, individuals or households making above a certain salary threshold received less stimulus funding2 – but this financial shot in the arm also benefitted relatively high-income households.3

Once restrictions eased in 2021, this economic stimulus cumulated with unleashed demand, causing consumer prices to rise – most notably, housing prices rose to an uncomfortable level for many buyers. According to the Federal Reserve Bank of St. Louis, the median home price in the U.S. increased by nearly $157,000 between the second quarter of 2020 and the fourth quarter of 2022, at a rate of increase higher than historical averages. Bloated mortgage rates then compounded this problem starting in 2022.

The data in the chart above suggests that even high-income households are choosing to continue renting rather than buying a home, which generally necessitates more money and a longer-term commitment. On top of this, the U.S. has been mired in a housing shortage that began shortly after the Great Recession (2007-2009), significantly limiting options for hopeful homebuyers.

How High Earners Impact Demand

This market dynamic appears to have increased the proportion of “renters by choice,” or households who could afford to buy a home, but elect not to for various reasons. Because this renter segment isn’t renting by necessity, they can afford to be pickier with where they sign a lease.

Developers wanting to attract a higher-salary renter continue to get creative with the amenities they offer at new apartment properties – amenities designed to create convenience, security and community.4 Renters now expect conveniences like in-unit washers, soundproof walls, high-speed internet and more space in order to work remotely.5 Additionally, a high-income individual who finds themselves priced out of the home-buying market could instead choose to rent a single-family home, enjoying the suburban life while avoiding the commitment of a 30-year mortgage.

Higher-earning tenants, or the typical renter profile of a Class A property, are generally more financially able to adapt to rent growth.6 While all real estate investments carry some level of risk, newly constructed multifamily tends to fall on the lower end of the risk scale and has historically provided more consistent income returns. As a result, these are the kinds of properties that typically attract higher-income tenants.

The Bottom Line

Different types of multifamily bring with them a variety of investment pros and cons. While it has historically been the case that tenants of newer, core properties create a more reliable income stream than tenants of older, non-core properties, we have also observed that Class A assets garnering top-of-market rents are typically experiencing higher vacancy rates than B and C properties7, in large part because Class A properties regularly face new competition in the form of newly constructed apartments.

SOURCES

2 https://www.consumerfinance.gov/about-us/blog/guide-covid-19-economic-stimulus-checks/#qualify

3 https://www.brookings.edu/essay/lessons-learned-from-economic-impact-payments-during-covid-19/

4 https://archive.curbed.com/2019/3/26/18281713/rent-apartment-amenity-residential-real-estate

5 https://rentalhousingjournal.com/renter-preferences-survey-report-shows-the-future-is-remote-work/

6 https://www.realpage.com/analytics/market-rate-apartment-renters-spending-23-percent/

7 CONTI Capital analysis of CoStar data