How ‘Replacement Cost’ Can Afford Assets a Competitive Edge

Risk mitigation is often a high priority for commercial real estate (CRE) investors,1 which is especially relevant now, given increasing market volatility driven by higher interest rates and tighter lending standards. As such, when investors survey market opportunities, we advise them to give some consideration to properties priced below replacement cost, which can typically offer some insulation against fluctuating market conditions.

To say a property falls “below replacement cost” refers to the idea that if that existing property were built from scratch today, it would be more expensive to develop given significantly higher construction costs, including land, building materials, labor, and permitting. Therefore, when acquiring a commercial property at a significant discount to replacement cost, investors can potentially be afforded a safety margin and a competitive edge, all else being equal.

Subscribe now for more CONTI insights

Risk mitigation is often a high priority for commercial real estate (CRE) investors,1 which is especially relevant now, given increasing market volatility driven by higher interest rates and tighter lending standards. As such, when investors survey market opportunities, we advise them to give some consideration to properties priced below replacement cost, which can typically offer some insulation against fluctuating market conditions.

To say a property falls “below replacement cost” refers to the idea that if that existing property were built from scratch today, it would be more expensive to develop given significantly higher construction costs, including land, building materials, labor, and permitting. Therefore, when acquiring a commercial property at a significant discount to replacement cost, investors can potentially be afforded a safety margin and a competitive edge, all else being equal.

Subscribe now for more CONTI insights

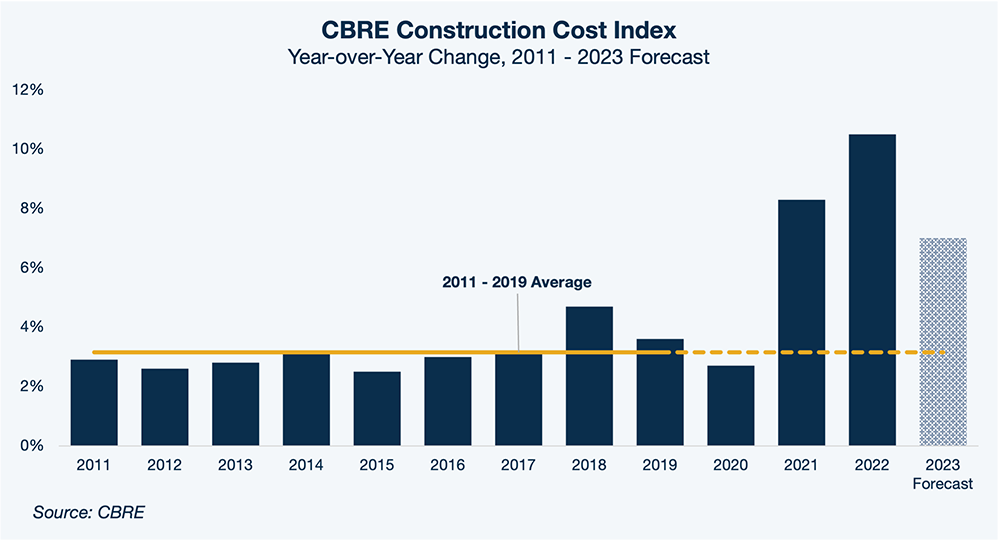

Increasing construction costs are far from a marginal factor: according to data from CBRE, commercial construction costs increased by 8.3%, year-over-year, in 2021 and by 10.5% in 20222.

For example, a hypothetical multifamily property (“Summit Villas”) that commenced construction in Summer 2020 and completed construction in early 2023 would have experienced very different development economics than a property starting construction today.

Effectively, such a situation insulates Summit Villas from new supply pressure as a new entrant to the area would have to lease units at significantly higher rents than Summit Villas just to remain profitable.

Assume, for example, that Summit Villas was acquired for $225,000 per unit and the owner plans to charge $1,700 in average monthly rent across all units. A brand-new property built today, based on prevailing construction costs, could cost $275,000 per unit to build. For this new property to reach at least a 6% untrended yield-on-cost, the owners would need to charge at least $2,300 per month—a $600 rent premium to Summit Villas—just to hit a very conservative return metric.3

With this calculation in mind, Summit Villas is insulated from new supply competition in two ways: 1) the property would be competitively priced compared to any new entrant in the area, cannibalizing demand; and 2) developers might ultimately opt to avoid new construction here altogether given the economics.

In short, this analysis suggests that investors should set aside any biases around investing in markets characterized by a relatively high volume of new multifamily construction. We have long maintained that national- and market-level trends are far less indicative of property-level performance than zip-code and micro-market supply and demand fundamentals. Properties acquired at a significant discount-to-replacement cost help mitigate oversupply risk through their cost advantages and competitive rent levels. This is one of many avenues by which investors can find lucrative opportunities in today’s multifamily market.

SOURCES

1 U.S. Treasury Bond yield curve

2 “United States Construction Market Trends, Q1 2023,” CBRE, March 2023

3 Calculations shown here are based on CONTI Capital’s modeling of a hypothetical scenario. As such, it is a simplification of a complex real-world phenomena and does not necessarily reflect all factors and uncertainties.