Remote Work’s Influence on Apartment Living

Remote work catapulted to wider prevalence in 2020 with the arrival of the COVID-19 pandemic, but years later, as coronavirus is declared no longer a public health emergency,1 rates of remote work are much higher than they were in 2019, despite a “return to office” effort by many employers.2 Estimates vary, but according to the Survey of Working Arrangements and Attitudes, as of February 2023, 40.3% of full-time employees were either fully remote or worked on a hybrid schedule.3 Remote work is having an outsized impact on office real estate, bringing down rents and occupancy across most markets, according to Green Street Advisors – a decline which is expected to continue into the foreseeable future.

Subscribe now for more CONTI insights

Remote work catapulted to wider prevalence in 2020 with the arrival of the COVID-19 pandemic, but years later, as coronavirus is declared no longer a public health emergency,1 rates of remote work are much higher than they were in 2019, despite a “return to office” effort by many employers.2 Estimates vary, but according to the Survey of Working Arrangements and Attitudes, as of February 2023, 40.3% of full-time employees were either fully remote or worked on a hybrid schedule.3 Remote work is having an outsized impact on office real estate, bringing down rents and occupancy across most markets, according to Green Street Advisors – a decline which is expected to continue into the foreseeable future.

Subscribe now for more CONTI insights

The Multifamily Impact

The work-from-home (“WFH”) phenomenon impacts how a significant proportion of the population lives, including how and where they rent, and thus the continuation of the work-from-home phenomenon holds significance to multifamily real estate. The impact to multifamily is very different than the impact to office: Whereas WFH appears to be decreasing demand for office real estate, multifamily real estate appears to be experiencing shifts in demand trends because of remote work. For instance, a meta-study by the Economic Innovation Group indicates that the work-from-home trend coincides with a shift in demand away from city centers and more expensive markets and toward suburban areas in more affordable areas4 – trends we’ve seen reflected in housing demand.5

Amenities are also a major component of remote work’s impact on multifamily demand, according to a 2022 survey of renter preferences by the National Multifamily Housing Council.6 The number of renters expressing a desire for increased square footage grew by a significant margin, perhaps signaling a growing need for home office space. Soundproof walls and high-speed internet were also high priorities, according to the survey.

Where Are Remote Workers?

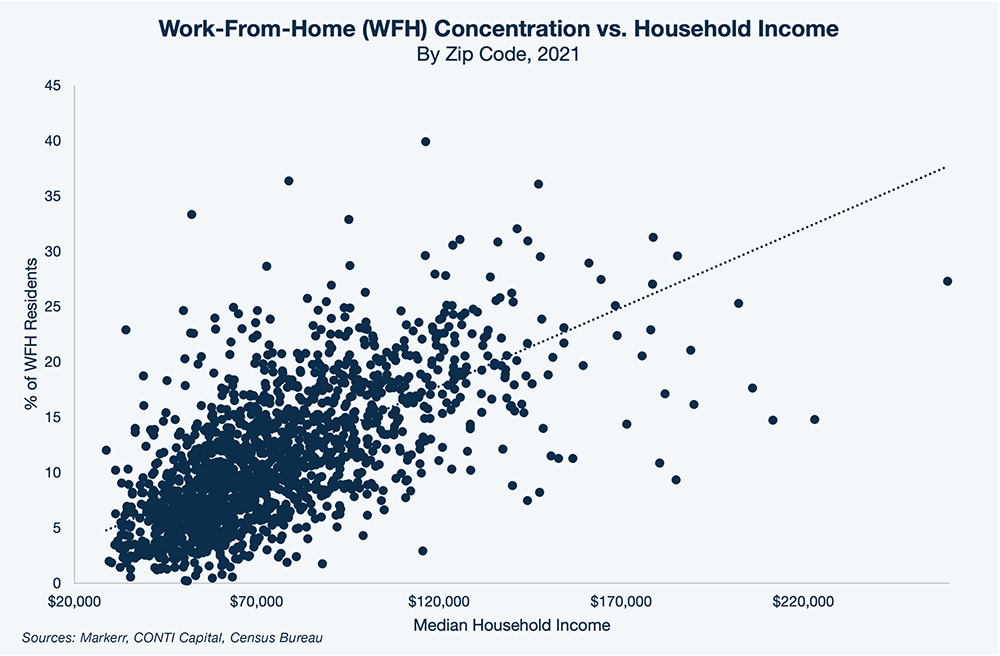

Given what we know about the influence of WFH, it begs the question, which submarkets are benefiting from this trend the most? Here’s a clue – remote workers tend to fall within office-using industries like technology, finance and business services, all industries associated with higher-than-average salaries.7 We analyzed the concentration of remote workers across geographic areas using Markerr data and found a significant relationship between remote work and higher incomes.

Every dot in the chart above represents a single Sun Belt zip code, plotted against both median household incomes and the share of residents within each zip code that worked from home as of the end of 2021. As the trend line shows, there is a very strong correlation between income and WFH concentrations at the zip code level.

This is of particular interest to us because, as we’ve detailed before, higher-income workers correlate with demand for higher-end, Class A properties. Investors seeking a greater degree of capital preservation might be interested in these properties because the higher-income tenant profile tends to generate steadier cash flow via rents than those of Class B or C properties.

The 10 zip codes included in this list are derived from Markerr’s allocation of remote work by zip code across CONTI Capital’s target Sun Belt markets, based on Census Bureau data as of 2021. We focused our analysis on our key markets within the Sun Belt region because of their multifamily fundamentals, such as their robust job creation and affordability relative to Gateway markets such as Los Angeles. Zip codes with a population lower than 10,000 were excluded.

Below are the zip codes within our Sun Belt markets where we find the highest concentration of remote workers:8

1. 85255 – Scottsdale, AZ: This upmarket zip code includes parts of the McDowell Mountain range, providing residents recreational opportunities, which we think is a big draw for individuals working from home. The median household income in this zip code is currently $144,000 and apartment renters devote an unusually low share of their incomes to rent.

2. 78746 – Austin, TX: This Hill Country zip code is home to the affluent cities of West Lake Hills and Rollingwood, and part of the well-regarded Eanes Independent School District. Residents here are a short drive from the popular stretch of retail and restaurants on South Congress, as well as Barton Creek Greenbelt.

3. 76092 – Southlake, TX: The median annual income within this Dallas/Fort Worth metro zip code is a whopping $278,000 as of February 2023. Global software developer Sabre Corporation is located within the zip code. There are no apartment properties in the zip code itself, which could mean pent-up apartment demand exists in this area.

4. 27514 – Chapel Hill, NC: The University of North Carolina at Chapel Hill, a major player within the “Research Triangle,” is located in this zip code, and it’s possible that the flexibility of academic employment would lead to a larger remote workforce. Perhaps as a result, median incomes in the zip code are more moderate than the others included in this list (about $89,000 as of February 2023).

5. 30075 – Roswell, GA: Residents of this prosperous area just north of Atlanta have median household incomes of about $150,000 as of February 2023, with young adults earning as much as $134,000—well ahead of the national median for this age group of about $74,000.

6. 30005 – Alpharetta, GA: Just to the east of the 30075 zip code, this suburban area has a similar income profile to Roswell. Renters in the area devote only 18% of their incomes to rent, well below the typical “rent-burdened” threshold of 30%. Renting an apartment also makes a lot of sense in this zip code, as the average rent level is 37% cheaper than the average mortgage payment.

7. 75082 – Richardson, TX: North of the city of Dallas, this suburban zip code is home to a segment of the Telecom Corridor, known for its cluster of telecommunications businesses, including Fujitsu’s headquarters and Ericsson’s U.S. headquarters. Median incomes are over $125,000, which is almost 50% higher than the Dallas MSA median income.

8. 30041 – Cumming, GA: Pressed up along the western edge of Lake Lanier, this high-income zip code offers numerous recreational opportunities. 16% of the workforce in this zip code is employed in professional, scientific and technical services—a segment that is particularly conducive to remote work.9 The population of the zip code has been growing at about a 4% rate in recent months, compared to effectively flat growth in the Atlanta MSA.

9. 75078 – Prosper, TX: As part of DFW’s fast-growing northern suburbs, this zip code is typical of the WFH-heavy areas in this list, with a median income close to $200,000. Employment is concentrated in high-paying office-using professions. What sets this zip code apart from others in the list is its exceptionally high population growth rate: 11% year-over-year growth as of March 2023.

10. 30309 – Atlanta, GA: This area just to the north of Downtown Atlanta is unusual compared to the other zip codes in this list as it’s more urban than the others and the age profile is heavily concentrated among younger adults: nearly half the population is between the ages of 25-34. Given these characteristics, it’s no surprise that about half the residents in this zip code are renters.

Looking Forward

Our house view is that there will ultimately be a more pronounced return-to-office movement, but that this will most likely occur over a number of years, rather than all at once. In the short term, we expect the residential market will probably continue to feel the impact of the work-from-home trend. Because jobs are a major factor contributing to apartment demand, we will continue to watch remote-work and hybrid-work trends as we adapt in a shifting multifamily investment environment.

SOURCES

1 https://www.cdc.gov/coronavirus/2019-ncov/your-health/end-of-phe.html

2 https://time.com/6281252/return-to-office-hybrid-work/

3 https://wfhresearch.com/wp-content/uploads/2023/05/WFHResearch_updates_May2023.pdf

4 https://eig.org/wp-content/uploads/2023/04/Remote-Work-and-Household-Formation.pdf

5 Brookings Institute, “Did the pandemic advance new suburbanization?”, May 23, 2022.

6 https://rentalhousingjournal.com/renter-preferences-survey-report-shows-the-future-is-remote-work/ .

8 Supporting data on income, demographics, and housing are based on Markerr’s Income and Employment dataset, which is derived from payroll records.