Are U.S. Metros Facing an Oversupply of Apartments?

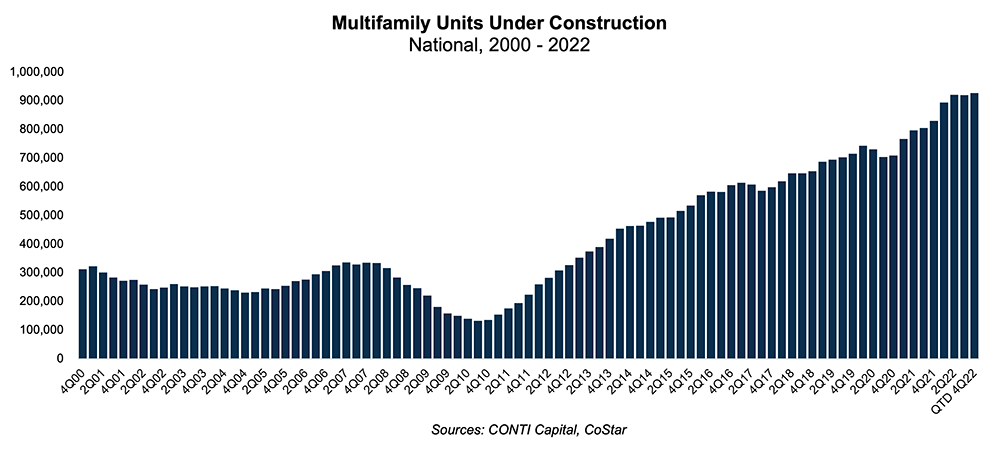

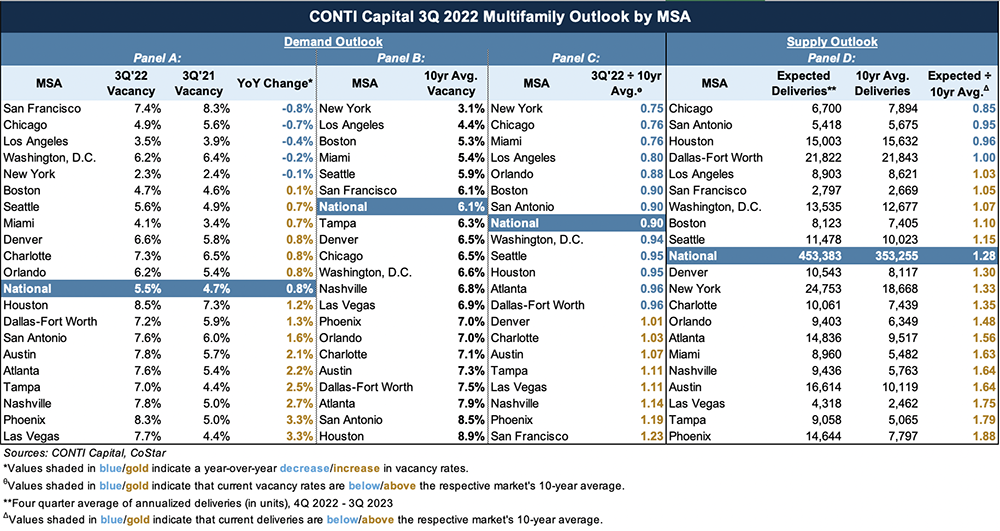

Several key U.S. metros are seeing a full pipeline of apartment supply headed toward lease-up in the coming months, as we see in the graphic below. At the same time, the national apartment market experienced a notable slowdown in the third quarter of the year, with negative net absorption, per market data. Does this mean U.S. metros are facing a glut of apartment supply? In CONTI’s perspective, the signs paint a nuanced picture, but there’s still demand to be tapped in the multifamily market.

Subscribe now for more CONTI insights

Where is Supply Coming From?

In the early months of the COVID-19 pandemic, housing construction starts took a drastic dip as builders paused to take stock of the unusual circumstances. While construction ramped back up again in the later months of 2020, the monthslong pause only served to exacerbate an existing housing shortage of both single-family and multifamily homes.

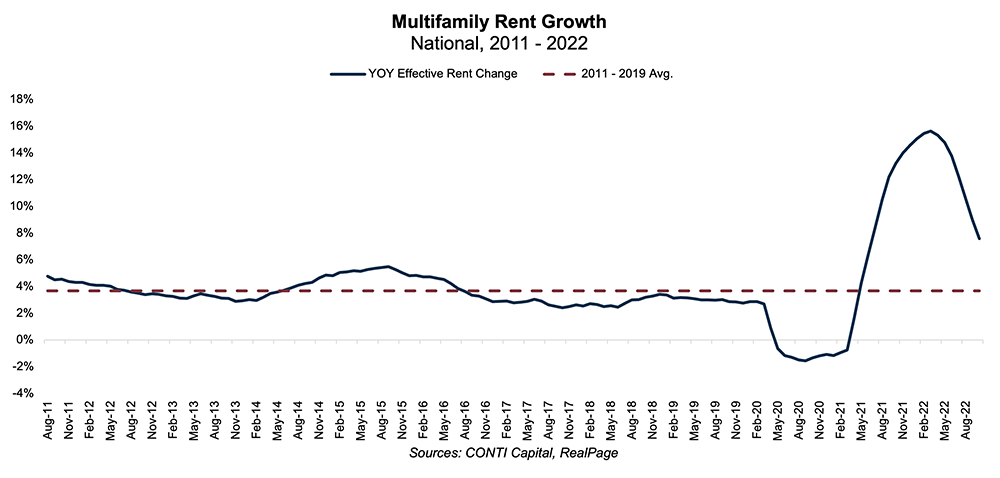

Multifamily construction has remained high since that time, and a wave of new household formation around the start of 2021 ensured apartment vacancies stayed low. This burst of demand propelled accelerated rent growth in 2021 and early 2022.

Yet in the third quarter of 2022, the tide appears to be ebbing. U.S. effective apartment rents fell by 0.14% in September 2022, per the chart below, signaling the start of a slowdown in market momentum. In October, rents fell by another 0.5%. In our view, though, the national market is performing reasonably well considering that year-over-year effective apartment rents continued to grow by 7.6% in October, per the chart below. For perspective, the average annual growth rate from 2011 to 2019 was 3.7%. Notably, the data tells us that national occupancy rates are still at a healthy 95% as of October 2022.

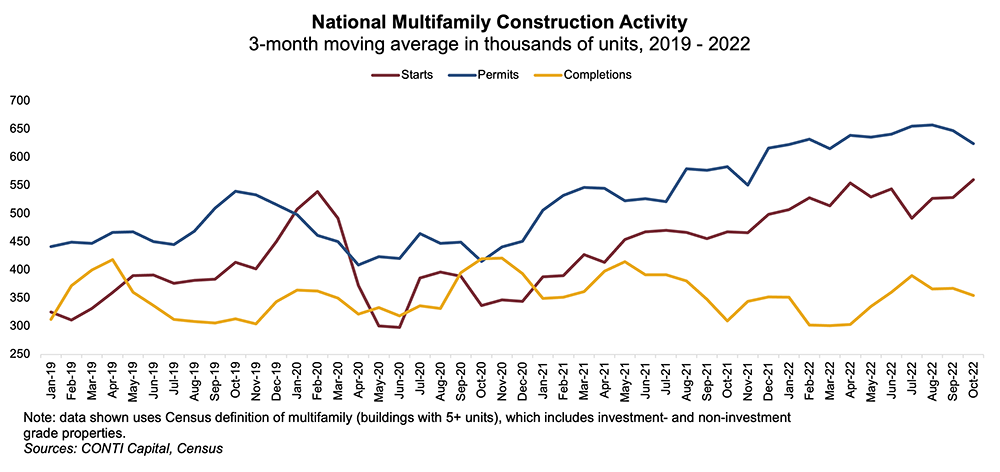

October Construction Levels

Construction of professionally managed multifamily properties slowed from September to October, according to Census data, but construction has ramped up compared to a year ago. In October, 633,000 units (within projects of 5 units or more) were permitted – a 1.9% drop from September, but still 11.2% higher than October 2021. Additionally, 556,000 units began construction in October, 0.5% lower than the month before but 17.3% higher than a year ago. Though we believe the month-over-month drop in construction activity could be related to recession fears, the decline in multifamily construction is not as drastic as the slowdown in construction of single-family homes.

There are factors that suggest the construction pipeline might not be as formidable as it first appears. Builders still face ongoing materials shortages, per what we have seen in the market. This has led to an unusually high number of projects which are authorized, but not started, putting a damper on unit deliveries. In October, the number of apartment units authorized but not started was 31.5% higher than a year ago, per Census data.

We have also observed that a majority of apartment projects slated for construction are mid- and high-rise buildings, or the sort of projects with a longer construction timeline than garden-style apartments.

Inflation’s Impact on Demand

That being said, expected deliveries are higher than 10-year historical averages across many major metros, according to our analysis of CoStar data, so concerns about oversupply are understandable. The proportion of units authorized or under construction are substantial when compared with existing supply. Additionally, apartment vacancy rates were higher in the third quarter of 2022 than they were the year before, painting a picture of tempered demand. While vacancy rates were lower in the third quarter than their 10-year average, it isn’t a huge difference – meaning many metros are returning to baseline vacancy rates.

Housing demand is subdued amid an uncertain economic picture. People would historically rather not move to a new apartment when inflation is high and the possibility of a recession looms, per RealPage. Yet this suggests a rebound in demand once the dust settles and fears lessen. This could occur as early as the spring of 2023, based on our forecast scenarios.

Despite economic conditions causing people to take a wait-and-see approach to housing, we observe that demographics are still favorable to multifamily. The millennial generation is larger than any generation before it, and overlaps heavily with our “preferred renter” demographic, which analysis suggests is a superior predictor of apartment demand. Many millennials, in the midst of getting married and starting families, have found they cannot afford to buy a home in the current housing market.

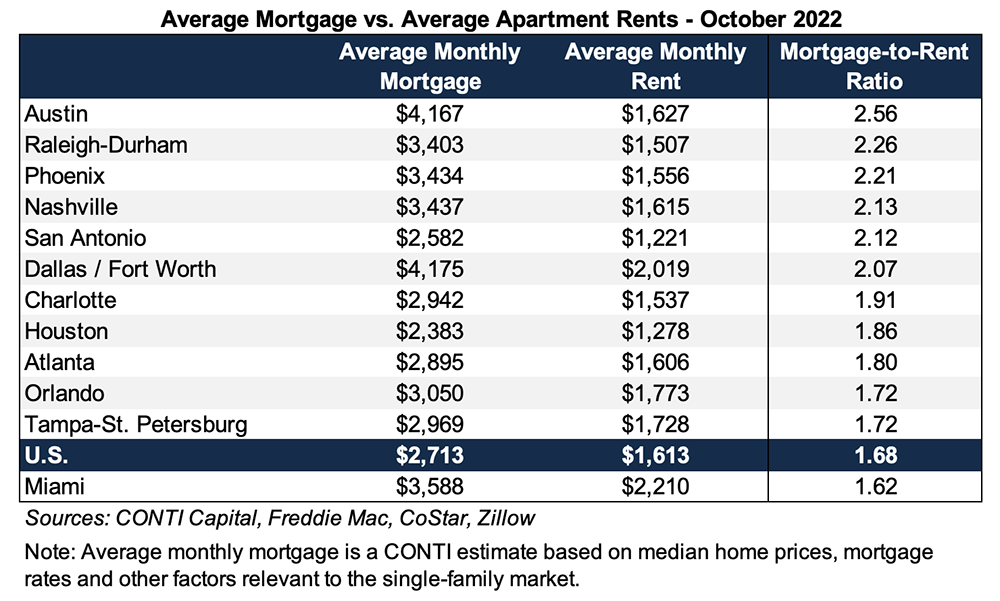

Considering the rapid climb of mortgage rates within recent months, it’s more financially feasible for many people to rent rather than take on the financial commitment of buying a home, as seen on the table below.

Our Acquisitions Strategy

CONTI Capital holds that making smart acquisitions decisions requires looking more closely – beyond the market or even submarket level, down to fundamentals performance on a zip code basis. We’ve detailed this thesis before, but we feel it becomes particularly relevant in times of market shift. When we use our proprietary data science-based site selection tool, the CONTI Index, we can see there is a great deal of fundamentals variation even within a 1-mile radius, let alone within a 3 to 10+ mile submarket. An apartment property could see varying levels of return based on innumerable factors which include the local job market, surrounding home values, area income levels, proximity to major roadways and more.

CONTI will only pursue the acquisition of a property if it meets our ideal performance standards. When we evaluate an area or a property, we are able to score each based on hundreds of leading indicators and millions of data points. One of the primary factors we weigh, of course, is supply – not only of existing apartment properties, but the ease by which future apartments could be permitted and built. That way we can ascertain a measure of how in demand a certain asset could be years into the future.

In summary, we are seeing increased levels of supply and some moderation in apartment demand, but this is why we go back to our strategy of weighing hundreds of factors on a hyperlocal level. We are seeing what we consider to be strong opportunities to buy properties at preferable prices, and we continue to monitor market conditions daily. We are also optimistic that, once economic fears subside, we will see a significant amount of apartment demand return to the market.

SOURCES

Federal Reserve Bank of St. Louis: Housing starts

National Association of Realtors: Housing Shortage Tracker

Federal Reserve Bank of St. Louis: Rental Vacancy Rate

U.S. Census Bureau: New Residential Construction

Pew Research Center: Millennials Overtake Baby Boomers as America’s Largest Generation

Pew: More Housing Is Coming – But the National Shortage Will Persist

National Association of Realtors: Existing Home Sales Slumped 5.9% in October