Dallas-Fort Worth is CONTI Capital’s #1 Multifamily Market

Universal Studios announced at the start of the year that they’ve chosen the Dallas suburb of Frisco as the site of their next family-friendly theme park. The 97-acre park is just one piece of a larger 2,500-acre, $10 billion development that is planned to bring as many as 14,000 housing units, commercial space and two PGA golf courses to the Dallas area.

Frisco’s massive development is just one project in a larger growth trend for the Dallas-Fort Worth Metroplex. Just to name a few upcoming projects and corporate relocations: NexPoint has recently announced plans for a 200-acre life sciences development in Plano with 4 million square feet of lab and office space. Boingo Wireless plans to move their Los Angeles headquarters to Frisco1. Goldman Sachs’ new 950,000-square foot office in the heart of Dallas is expected to cost nearly $500 million1. Wells Fargo is building a large project in Irving which could house as many as 4,000 workers1. Caterpillar also announced last year that they’ll be moving their operational headquarters from Peoria, Illinois to Irving.

Subscribe now for more CONTI insights

Universal Studios announced at the start of the year that they’ve chosen the Dallas suburb of Frisco as the site of their next family-friendly theme park. The 97-acre park is just one piece of a larger 2,500-acre, $10 billion development that is planned to bring as many as 14,000 housing units, commercial space and two PGA golf courses to the Dallas area.

Frisco’s massive development is just one project in a larger growth trend for the Dallas-Fort Worth Metroplex. Just to name a few upcoming projects and corporate relocations: NexPoint has recently announced plans for a 200-acre life sciences development in Plano with 4 million square feet of lab and office space. Boingo Wireless plans to move their Los Angeles headquarters to Frisco1. Goldman Sachs’ new 950,000-square foot office in the heart of Dallas is expected to cost nearly $500 million1. Wells Fargo is building a large project in Irving which could house as many as 4,000 workers1. Caterpillar also announced last year that they’ll be moving their operational headquarters from Peoria, Illinois to Irving.

Subscribe now for more CONTI insights

Companies bring projects to Dallas because of the metro’s consistently robust population growth, business-friendly posture, relative affordability, well-connected transportation network and young, skilled demographic profile. Corporate relocations to Dallas help increase jobs and wages2, then the economic growth of the area encourages more in-migration, and the cycle of growth continues.

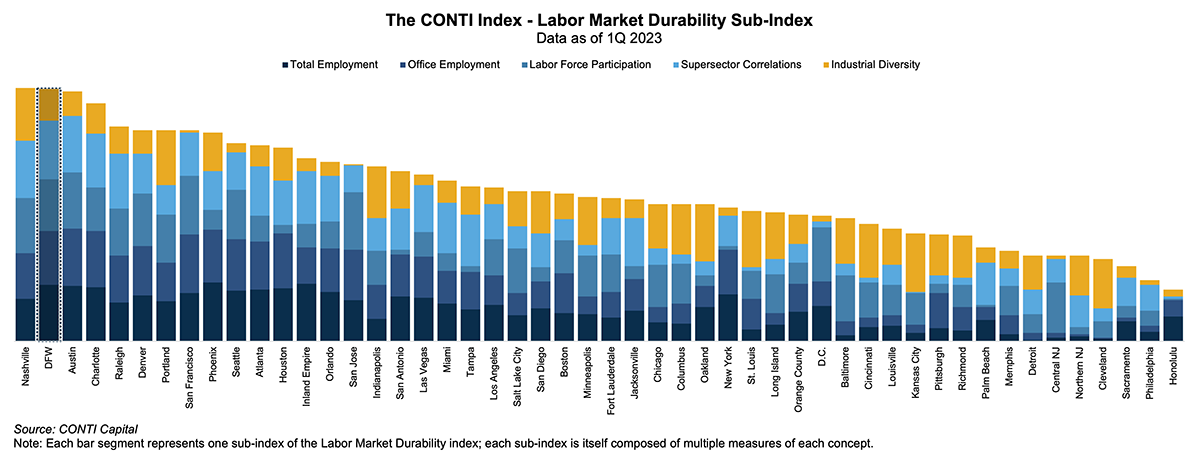

Dallas is CONTI Capital’s #1 Market for Multifamily Investment for the first half of 2023. CONTI Capital analyzed 50 major U.S. metros using the CONTI Index, our proprietary data modeling tool that measures more than 400 leading performance indicators. According to our own data analysis, the industry diversity of Dallas’ labor market and the significant proportion of residents that fall within CONTI Capital’s “prime renter” age range are the primary factors that boosted Dallas to the top of our list for the second time in a row.

By the Numbers: A Standout Job Market

We’ve remarked previously that Dallas’ strength across a multitude of industries helps to insulate the local economy from negative impacts to any one industry. DFW frequently outperforms the other Top 50 metros when it comes to job growth across most major employment sectors, including health and education, FIRE (finance, insurance, real estate), TAMI (technology, advertising, media, information) and professional and business services at large. Many of these employment sectors correlate closely with apartment demand.

As of the end of 2022, total employment levels in DFW topped 4.2 million, with an unemployment rate of 3.2%, according to data from the Bureau of Labor Statistics (BLS). While the DFW economy has no doubt benefited from the short-term, pandemic-related factors that boosted Sun Belt market performance over that of the Gateway metros, the long-term structural demand drivers are far more important to us. To that end, our labor market specific sub-index within the CONTI Index is called “Labor Market Durability” because it measures structural factors that are conducive to long-term economic development, not just short-term economic growth. DFW is our second-best market in this sub-index.

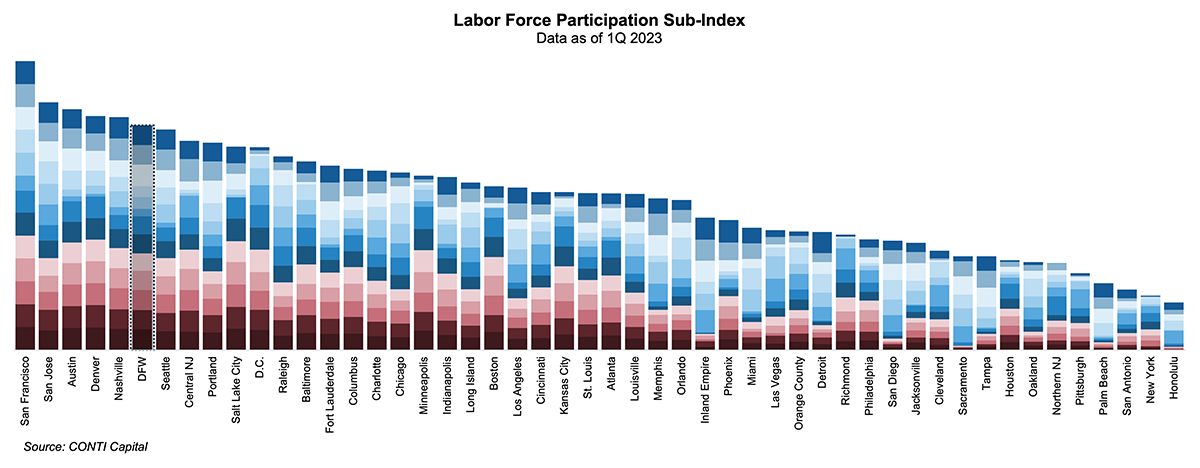

For example, we place significant weight on labor force participation trends because we believe this measure is tied to the long-term structural health of a market. As a result, we want to be in markets characterized by higher participation, which tends to correlate with a favorable age profile, higher educational attainment and a stronger tax base. Across the 13 different ways we measure labor force participation trends, DFW is one of the top markets for both current participation and growth in participation over the past 3 years.

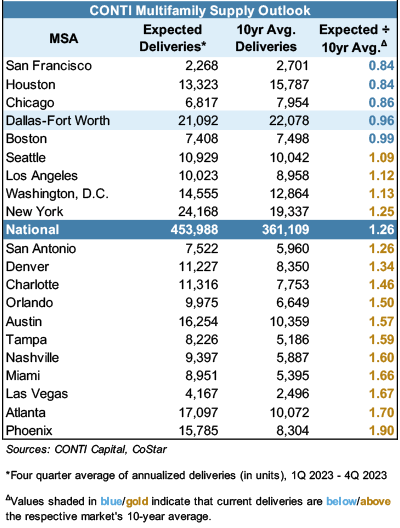

It’s hard to overstate the relevance of a healthy labor market in terms of its impact on apartment demand, as the two are closely intertwined. As we encounter mounting economic uncertainty in the coming months brought about by rising interest rates, we will be watching the economic performance of DFW with particular interest. Though this market is one of many major metros facing a significant pipeline of apartment supply in the near term, the strength of metroplex’s job market should help temper any mellowing out in apartment demand in the coming year. Notably, though, based on CONTI’s modeling of multifamily data from CoStar, DFW is one of 5 major apartment markets expecting to see a lower number of unit deliveries over the next four quarters relative to the average over the past 10 years.

Human Capital

Dallas outperforms the Top 50 markets in total population growth, net migration and household formation. The metro population has increased by about 122,000 annually over the past 10 years, far ahead of most other U.S. metros. Green Street Advisors calls Dallas “one of the most desirable markets for young residents,” based on the relative proportion of 25 to 44-year-old residents. Within our “Demographic Destiny” sub-index, DFW is one of the top performers across the many ways we conceptualize net migration. Whether assessed currently, in the forecast or over the past 2 to 5 years, DFW is easily in the top 3 markets for the sheer number of people moving to the metro. We are expecting a little less than 52,000 people to move to DFW by the end of this year.

Considering that almost a third of the labor pool in DFW is comprised of degrees in finance, engineering, computing and other technical fields3, it makes sense that companies would want to locate their business operations within this large well of educated workers.

Apartment Market Expectations

Like the nation, the DFW metroplex is currently experiencing a slowdown in demand while inflation and mounting concerns of a recession dampen households’ desires to sign new leases4. Nevertheless, the core sources of apartment demand remain on firm ground in DFW. In particular, the labor market is both strong and structurally supportive of long-term growth. Tens of thousands of individuals continue to relocate to the metroplex, generating further need for housing.

As economic headwinds begin to dissipate further into 2023, we anticipate a probable return to above-average demand growth as pent-up demand for housing is unleashed. The supply pipeline—despite being elevated—is actually quite commensurate with changes on the demand side. It is important to recall that our approach to site selection favors a zip-code level analysis using our proprietary technology tool. While market-level trends are relevant to this approach, they are not determinative of the micro-level supply and demand drivers that are at the heart of our acquisitions process.

SOURCES

1 CoStar

2 Green Street Advisors

3 Green Street Advisors

4 CoStar