Multifamily More Resilient Than Other CRE Types During Economic Downturns

Will the U.S. enter a recession in 2023, as many economists are now predicting? There’s a significant chance that recessionary conditions could strike sometime in 2023 or possibly early 2024, based on various leading economic indicators.

In this piece, we will touch on why a recession could occur this year and parse some historical data demonstrating the performance of multifamily real estate in times of economic uncertainty.

Subscribe now for more CONTI insights

How did we get here?

In an effort to combat runaway inflation stemming from the economic distortions of the COVID-19 pandemic, the Federal Reserve aggressively hiked interest rates throughout 2022, taking the federal funds rate from essentially 0% to a range of 4.25% – 4.50% by year-end. Interest rate hikes exacerbated housing affordability challenges and tightened overall financial conditions. Though interest rates today are not particularly high compared to historical averages, hikes have come at an unprecedented rapid-fire cadence compared with previous rate hike schedules.

As we’ve previously discussed, rate hikes are something of a blunt instrument for combatting inflation. For instance, the Fed is powerless to take measures to untangle snags in the supply chain that have contributed to broad price inflation. However, by tightening overall financial conditions, the Fed can cool the labor market by raising the cost of debt, which squeezes firm profit margins, leading to a slowdown in business investments and, ultimately, the pace of hiring. The Fed aims to slow hiring, reduce the number of job openings, and ultimately reduce the rate of wage growth.

It’s important to note, though, that the labor market has thus far shown remarkable resiliency in the face of rapid interest rate hikes. The unemployment rate in December 2022 returned to a 50-year low. This indicates to us that if a recession does occur in the next 12 months, it would not be as severe nor long-lasting as the Great Recession (2007-2009).

Multifamily adapts relatively well during recessions

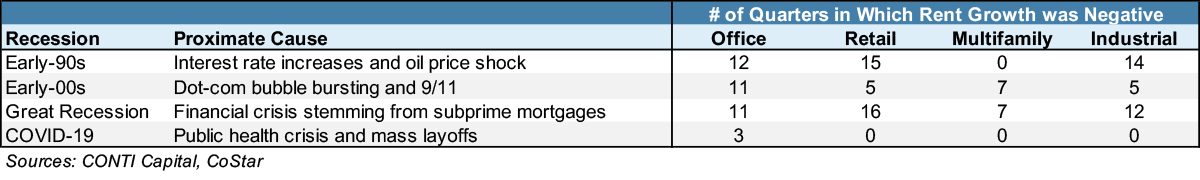

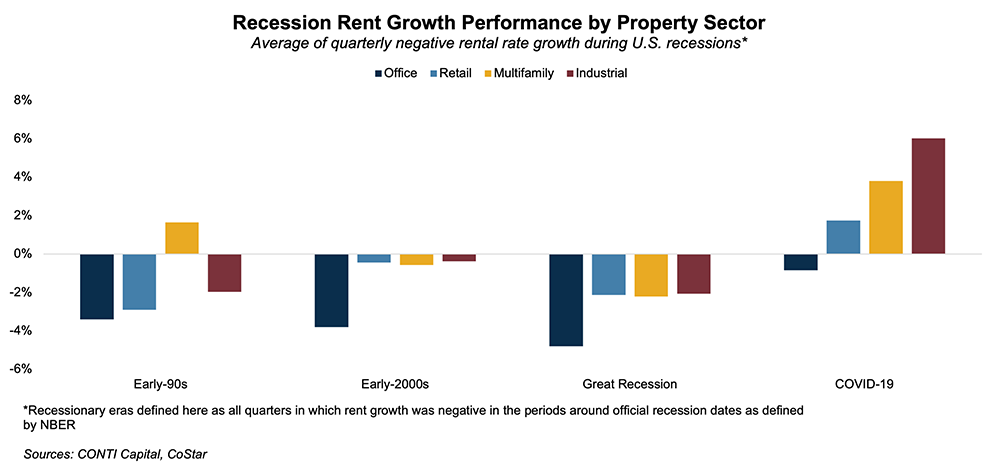

Recessions, as we’ve mentioned, differ in length and severity, and can be brought about by varying combinations of economic factors. Different recessions will have different impacts on commercial real estate.

The recession of the early 1990s was largely catalyzed by rising interest rates and an oil price shock. The office and retail sectors experienced the greatest impact during that downturn, likely due to the subsequent “jobless recovery” that caused office-using employment and retail spending to plummet. Multifamily was the only major property type to experience positive rent growth in this instance.

All property types experienced negative rent growth during the early-2000s tech bubble, but the office sector bore the brunt of the impact as a result of the collapse of several high-profile dot-com firms and the related decline in tech employment.

The Great Recession—the most severe downturn since the Great Depression in the 1930s—was triggered by a global financial crisis and was followed by a prolonged jobless recovery. All major CRE sectors experienced negative rent growth, most especially office. The depth and severity of the Great Recession pushed many renters to move back in with family or double-up with roommates, causing a sharp decline in demand. However, the recovery in multifamily was relatively swift compared to that of office and industrial real estate.

The economic fallout borne out of the once-in-a-generation pandemic that struck in 2020 had a unique impact on CRE. Stay-at-home orders caused offices to suffer while housing needs remained strong, and government stimulus helped boost consumer spending, particularly online shopping. As a result, rent growth was positive for industrial, multifamily, and retail. Many retail businesses (particularly restaurants and bars) closed nationwide, but several federal programs provided a lifeline to companies, ensuring the impact on retail wasn’t as severe as it could have been. However, office real estate didn’t receive the same sort of assistance as offices went underutilized. Now remote work has increased in prevalence beyond its utility during a public health crisis, which will likely lead to lower leasing and higher vacancy in the office sector.

It’s worth remembering that economic impacts will also vary by region. At CONTI Capital, we focus on target markets within the Sun Belt characterized by robust labor markets and demographics, which are a boon to the local economy.

One core thesis here at CONTI Capital is that multifamily is adaptable to change because it is essential – people will always need a place to live. The historical data bears this out – financial markets can turn bearish, consumers might need to tighten their belts, and companies might suffer financial losses, but apartments serve a critical need in good times and in bad. For the sizeable population of Americans who either cannot afford to buy a home or simply prefer not to, apartments offer cheaper and lower-commitment housing options. This is especially relevant now, considering the degree to which interest rates have pushed upward on mortgage rates.

Other countries around the world are also facing recessionary conditions on the horizon. The U.S. has historically been considered a safe haven for investor capital across the globe because of the well-regulated financial institutions here. Thus, we expect the U.S. will continue to benefit from any “flight to safety” that occurs if recessions take hold globally.