In this piece, we will touch on why a recession could occur this year and parse some historical data demonstrating the performance of multifamily real estate in times of economic uncertainty.

In the early months of the COVID-19 pandemic, housing construction starts took a drastic dip as builders paused to take stock of the unusual circumstances. While construction ramped back up again in the later months of 2020, the monthslong pause only served to exacerbate an existing housing shortage of both single-family and multifamily homes.

The impact of the 2 percentage point hike between late December of 2021 and mid-April of 2022 was equivalent to a breathtaking 27% jump in the cost of buying a home, per the Harvard housing study.

The #1 location for population growth was Georgetown, Texas, located within the high-growth Austin metro – one of CONTI Capital’s target markets for multifamily asset acquisitions.

This higher ratio value is fueled by a tight labor market, causing the demand for labor to press upward on the demand for housing. This is true in all the major metropolitan areas that CONTI tracks.

In the year ending in 1Q2022, total U.S. employment was up by 6.7 million jobs compared to the year ending 1Q2021, a period that included the worst months of the pandemic’s impact on the labor market.

First-time homebuyers who might have been able to secure a mortgage with little trouble a decade ago are facing increasingly difficult odds today.

In cities across the country, apartment hunters are in for a difficult time finding a place to call home – the U.S. multifamily market is effectively full, a phenomenon which has never occurred before.

Recently, the median home price in the U.S. reached a historic high of $379,700. Single-family home prices have been climbing drastically and this increasing lack of affordability has only accentuated the barriers to homeownership.

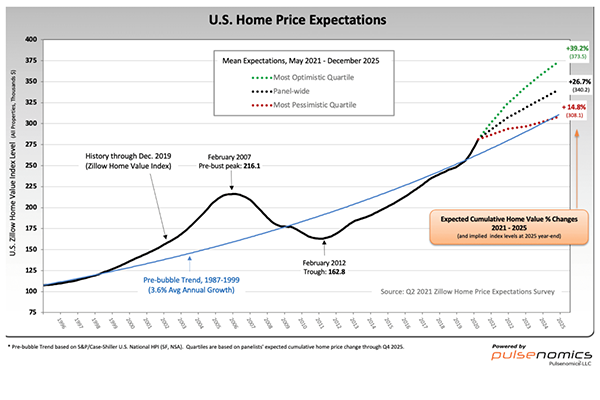

CONTI’s own home price forecast is forecasting 3 and 5-Year annual average home price growth to average 8.2% and 6.1%, respectively. Our 5-Year forecast is higher than the mean but lower than the optimistic growth recorded by the survey.